MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury yields were mixed, while municipal yields dropped this week.

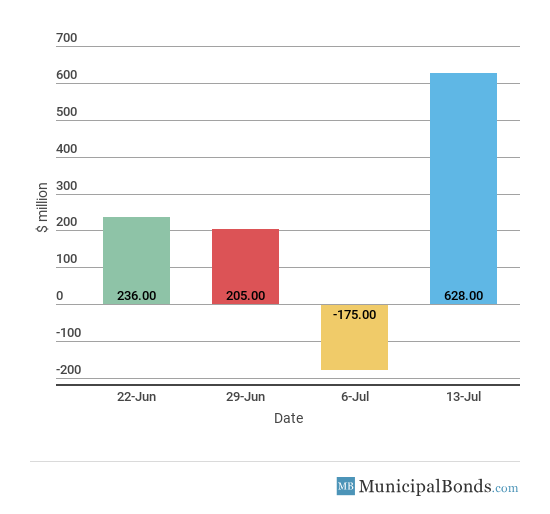

- Muni bond funds turned back to inflows this week.

- Be sure to review our previous week’s report to track the changing market conditions.

Tariff Talks Unable to Shake Consumer Confidence

- Fed Chair Jerome Powell is set to testify on Capitol Hill this week to discuss a three-page overview of a report that details the Fed’s ability to set interest rates with relatively new tools, like paying interest to banks.

- Consumer Price Index (CPI) saw a month-over-month change of 0.1%, slightly below the consensus of 0.2%. On a year-over-year basis however, CPI matched consensus at 2.9%. CPI data was driven by highs in medical care and vehicles.

- The Job Openings and Labor Turnover Survey (JOLTS) came in lower than expected at 6.638 million jobs versus the consensus of 6.700 million. Openings are above both hirings as well as the 6.564 million unemployed measure of people who are actively looking for work.

- The Bloomberg Consumer Comfort Index saw another increase to 58.0, which is a continuation of last week’s 57.6 positive reading. This is the highest measure since April, and it looks like the tariff talk had no real effect in the mind of consumers.

- Jobless claims saw a large decrease of 18,000 this week to a total of 214,000, which was lower than the consensus amount of 225,000. The four-week average decreased this week, bringing the total to 223,000, which is still hovering around record-low levels.

- The Fed’s assets increased by $1.4 billion this week, bringing the total asset base to around $4.291 trillion.

- During the week, money supply (M2) increased by $8.3 billion, a continuation of last week’s $15.1 billion increase.

Keep track of economic indicators that might impact the muni market.

Treasuries Mixed, While Municipal Yields Fall

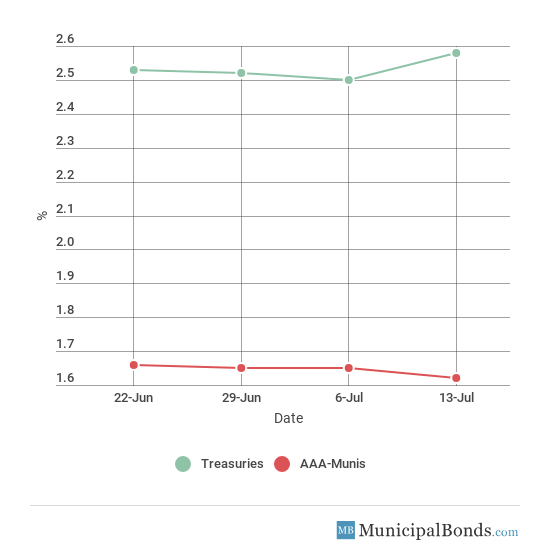

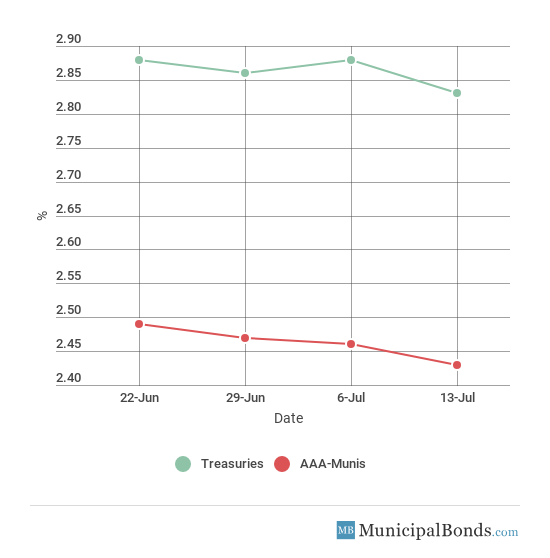

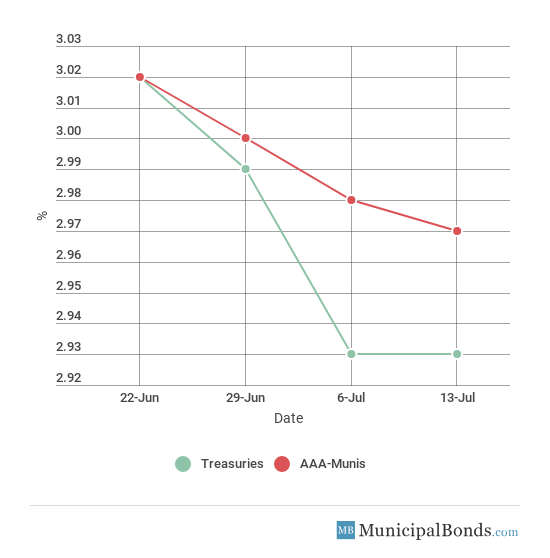

- Treasury yields mixed for the week, with the 2-year Treasury having an increase of 8 bps to yield 2.58%. The 10-year Treasury had a decrease of 5 bps and now yields 2.83,%. The 30-year Treasury yield saw no change and continues to yield 2.93%. Municipal yields were all down this week with the 2-year AAA-rated bond dropping 3 bps to yield 1.62%. The 10-year AAA-rated bond decreased by 3 bps to yield 2.43%, while the 30-year AAA-rated bond decreased 1 bps to yield 2.97%.

- Credit spreads increased this week, with the largest spread between the 2-year Treasury and the AAA-rated municipal bond still standing at 96 bps.

Be sure to check out our newly launched Municipal Bond Screener to explore muni bond CUSIPs across the U.S., based on custom parameters including the issuing state, insurance status and a range of different bond attributes such as maturity, coupon, price and yield.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

| 2-year | 2.58% | 1.62% | 96 |

| 5-year | 2.72% | 1.95% | 77 |

| 10-year | 2.83% | 2.43% | 40 |

| 30-year | 2.93% | 2.97% | -4 |

Muni Bond Funds Revert to Inflows Again

- After seeing a one-time outflow last week, municipal bond funds are back to inflows with an increase of $628 million in assets under management this week.

Colorado Health Facilities Authority Issues Hospital Revenue Bonds (CO)

The largest issue of the week came from Colorado Health Facilities Authority Hospital, which issued over $257 million revenue bonds this week. The proceeds are being used to help fund the Adventist Health System/Sunbelt Obligated Group, which owns 43 hospital campuses, 10 long-term care facilities, and 22 home health agencies across nine states.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s upgrades Galveston ISD, TX’s GOs to Aa2: Moody’s upgraded the Galveston Independent School District of Texas’ outstanding general obligation unlimited tax bonds (GOULT) to Aa2 from Aa3 this week. At the same time, Moody’s also assigned an Aa2 rating and an Aaa enhanced rating to $31 million of the Unlimited Tax School Building Bonds, Series 2018. The school district has had healthy growth of its reserves along with manageable pension liability.

Downgrade

Moody’s downgrades Bloomfield Hills Schools, MI to Aa1: Moody’s downgraded the Bloomfield Hills Schools of Michigan’s general obligation unlimited tax (GOULT) bonds to Aa1 from Aaa this week. This affects approximately $53.6 million of outstanding debt and was caused by the area’s elevated pension liability and its expected need to draw down on reserves this year.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page here.