MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury and municipal yields mostly dropped this week.

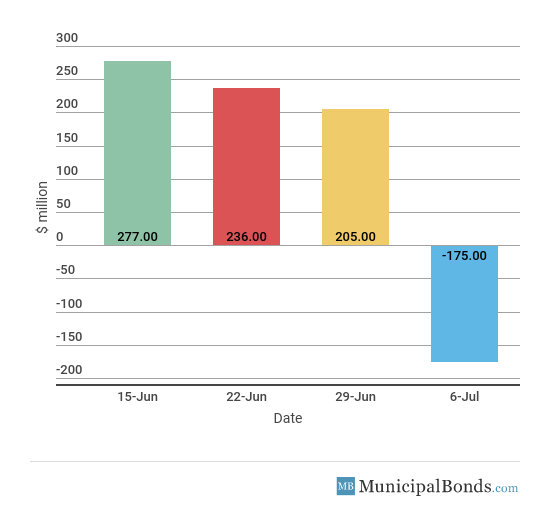

- Muni bond funds reversed inflow trend with outflows this week.

- Be sure to review our previous week’s report to track the changing market conditions.

Unemployment Remains Low at 4.0%

- The Employment Situation report for June was released on Friday, with nonfarm payrolls seeing a month-over-month change of 213,000, beating the estimate of 190,000. Private payrolls saw a month-over-month change of 202,000, also beating estimates of 182,000. Unemployment saw a slight increase to 4.0%, but all signs point to a very healthy labor market.

- The ADP Employment Report showed a strong measure of 177,000, even though it was lower than the estimate of 190,000.

- The Bloomberg Consumer Comfort Index saw another increase to 57.6, which is a continuation of last week’s 57.3 positive reading.

- Jobless claims saw an increase of 3,000 this week to a total of 231,000, which was higher than the consensus amount of 223,000. The four-week average increased this week, bringing the total to 224,500, which is still hovering around record-low levels.

- The Fed’s assets decreased by $15.7 billion this week, bringing the total asset base to around $4.29 trillion.

- During the week, money supply (M2) increased by $14.9 billion, a continuation of last week’s $20 billion increase.

Keep track of economic indicators that might impact the muni market.

Treasuries and Municipal Yields Mostly Fall

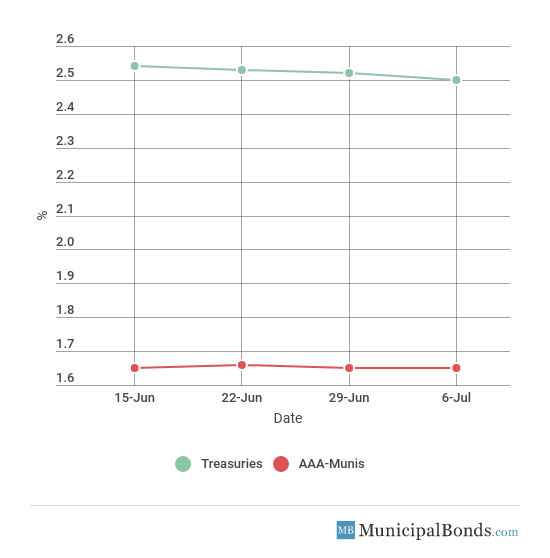

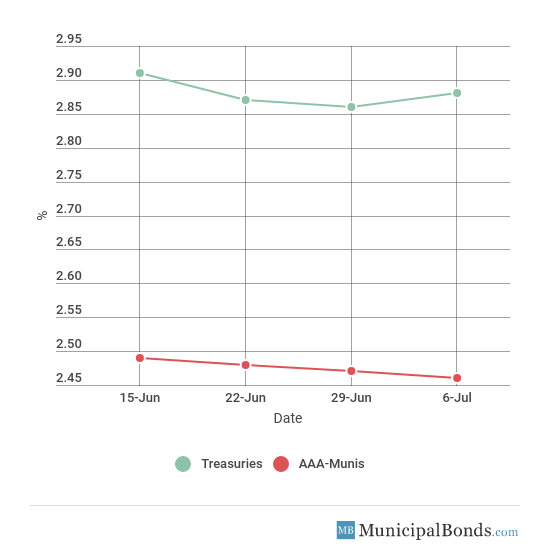

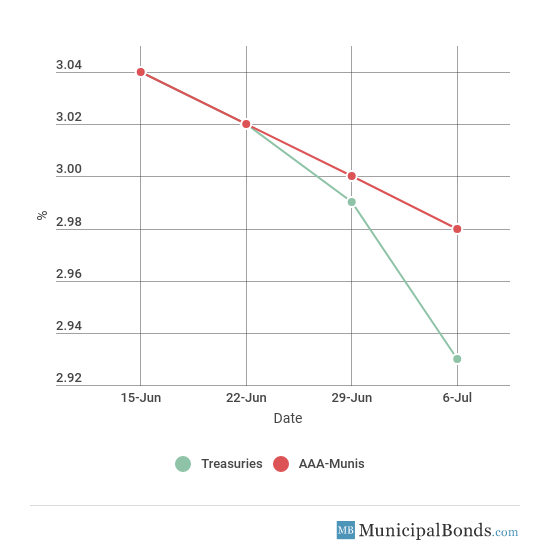

- Treasury yields mostly saw declines for the week , with the exception of the 10-year Treasury. The 2-year Treasury had a decrease of 2 bps to yield 2.50%. The 10-year Treasury had an increase of 2 bps and now yields 2.88,%. The 30-year Treasury yield decreased by 6 bps and now yields 2.93%. Municipal yields were also mostly down this week with the exception of the 2-year AAA-rated bond, which remained unchanged and continues to yield 1.65%. The 10-year AAA-rated bond decreased by 1 bps to yield 2.46%, while the 30-year AAA-rated bond decreased 2 bps to yield 2.98%.

- Credit spreads decreased this week, with the largest spread between the 2-year Treasury and the AAA-rated municipal bond still standing at 85 bps.

Be sure to check out our newly launched Municipal Bond Screener to explore muni bond CUSIPs across the U.S., based on custom parameters including the issuing state, insurance status and a range of different bond attributes such as maturity, coupon, price and yield.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

| 2-year | 2.50% | 1.65% | 85 |

| 5-year | 2.72% | 2.00% | 72 |

| 10-year | 2.88% | 2.46% | 42 |

| 30-year | 2.93% | 2.98% | -5 |

Muni Bond Funds Back to Outflows

- After a month of inflows, municipal bond funds saw outflows of $175 million this week.

County of Los Angeles Issues Tax and Revenue Anticipation Notes

The largest issue of the week came from the County of Los Angeles, California. The county offered $700 million of Tax and Revenue Anticipation notes. The notes are designed to provide monies to help meet the fiscal needs of the County for the 2018 and 2019 General Fund expenditures.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s upgrades Vanderbilt University, TN to Aa1; outlook stable: Moody’s upgraded the bonds for Vanderbilt University in Tennessee to Aa1 from Aa2. The upgrade impacts approximately $244 million of rated revenue bonds. The upgrade is due to an expected $1.4 billion increase to unrestricted liquidity this month as the university monetized a portion of the trademark license royalties it receives from its clinical partner, Vanderbilt University Medical Center.

Downgrade

Moody’s downgrades Forest Park, IL’s GO to Baa1; outlook negative: Moody’s downgraded the Village of Forest Park, IL’s outstanding general obligation unlimited tax (GOULT) and general obligation limited tax (GOLT) debt to Baa1 from A1. This affects approximately $7.2 million of outstanding debt and was caused by a weakening reserve status as the village is highly dependent on uncertain state revenue sources.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page.