MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury and municipal yields all decreased again this week.

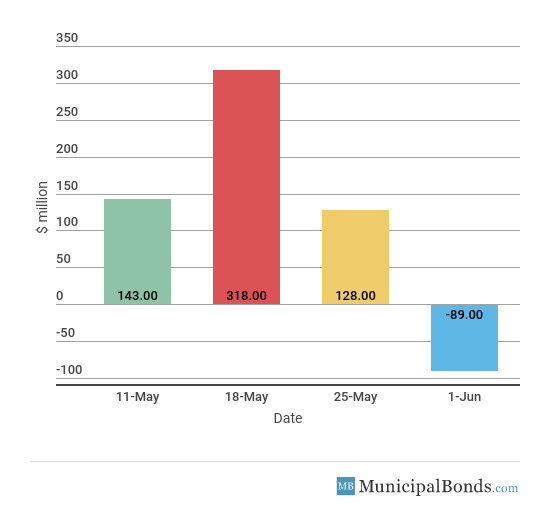

- Muni bond funds break the inflow trend with an outflow this week.

- Be sure to review our previous week’s report to track the changing market conditions.

Unemployment Hits 18-Year Low at 3.8%

- The Employment Situation was reported this week, with nonfarm payrolls seeing a month-over-month change of 223,000, which was higher than the consensus of 190,000. Private payrolls were also higher than the consensus of 184,000, coming in at 218,000. However, unemployment dropped 0.1% to 3.8%, an 18-year low.

- The Fed issued a proposal for easing the rules set by the Volcker Rule, which was created after the aftermath of the 2008 financial crisis. The proposed changes would simplify and tailor the rule without negatively affecting the safety of banks, according to a summary of the plan.

- The Bloomberg Consumer Comfort Index remained unchanged at 55.2. Although there was no change from last week, the level is still really high as consumers believe the economy is on the right track.

- Jobless claims saw a decrease of 13,000 this week to a total of 221,000, which was lower than the consensus amount of 224,000. The four-week average increased this week, bringing the total to 222,250, but it is still hovering around record-low levels.

- The Fed’s assets decreased by $9.8 billion this week, bringing the total asset base to around $4.328 trillion. The Fed has been reducing its balance sheet since September 2017, and for 2018, the Fed’s Treasury holdings will be reduced by $270 billion, while holdings of mortgage-backed securities will be reduced by $180 billion.

- During the week, money supply (M2) increased by $14.8 billion, a continuation of last week’s $27.1 billion increase.

Keep track of economic indicators that might impact the muni market.

Treasury & Municipal Yields All Decrease Again

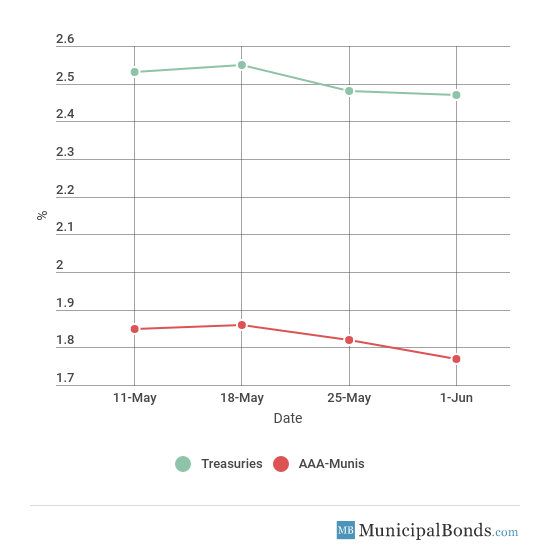

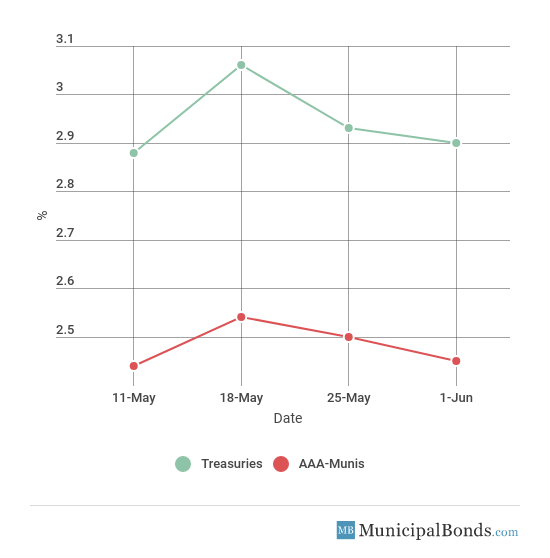

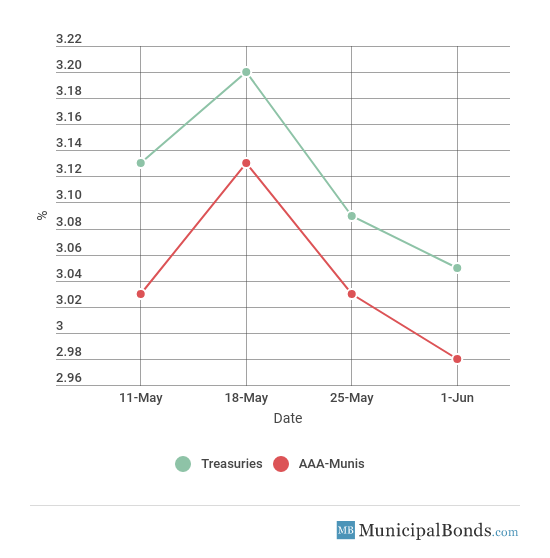

- Treasury yields all fell again this week, with the 2-year Treasury falling 1 bps to yield 2.47%. The 10-year Treasury had a decrease of 3 bps and now yields 2.90%. The 30-year Treasury yield decreased by 4 bps and now yields 3.05%. Municipal yields were also down this week with the 2-year AAA-rated bond falling 5 bps to yield 1.77%. The 10-year AAA-rated bond decreased by 5 bps to yield 2.45%, while the 30-year AAA-rated bond also decreased 5 bps to yield 2.98%.

- Credit spreads increased this week, with the largest spread between the 5-year Treasury and the AAA-rated municipal bond now standing at 73 bps. Meanwhile, the spread between the 30-year securities remained unchanged and is still at 6 bps.

Be sure to check out our newly launched Municipal Bond Screener to explore muni bond CUSIPs across the U.S., based on custom parameters including the issuing state, insurance status and a range for different bond attributes such as maturity, coupon, price and yield.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

| 2-year | 2.48% | 1.82% | 66 |

| 5-year | 2.75% | 2.02% | 73 |

| 10-year | 2.93% | 2.50% | 43 |

| 30-year | 3.09% | 3.03% | 6 |

Muni Bond Funds Break Inflow Trend

- After three consecutive weeks of inflows, muni bond funds saw outflows of $89 million this week.

Airport Commission of the City and County of San Francisco International Airport Issues Revenue Bond

The largest issue of the week comes from the City and County of San Francisco’s Airport Commission for the San Francisco International Airport. There are four different series: Series 2018D, with over $722 million that are subject to AMT; Series 2018E, with over $116 million that are non-AMT and for governmental purpose; Series 2018F, with over $7 million that are federally taxable; and Series 2018G, with over $35 million that are subject to AMT. The bonds are rated A+ by Fitch, A1 by Moody’s and A+ by S&P.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s Upgrades to Aaa Bridgehampton UFSD, NY’s GOs; Assigns Aaa to $24.2M 2018 GOs; Outlook Stable: The Bridgehampton Union Free School District in New York had $24.2 million of its general obligation bonds upgraded to Aaa from Aa1 this week. The area has a very affluent tax base, which has led to a very strong and stable financial position.

Downgrade

Moody’s Downgrades Needles Unified School District, CA’s GO rating to A2 from A1: Moody’s downgraded the Needles Unified School District of California general obligation bonds to A2 from A1. The area has seen its tax base shrink over the past ten years, which has put a strain on the school district’s financial status and debt levels.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page.