MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury and municipal yields all decreased this week.

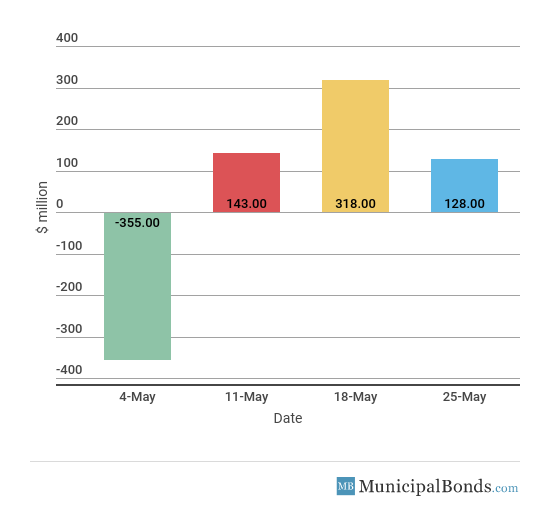

- Muni bond funds saw its third week of inflows.

- Be sure to review our previous week’s report to track the changing market conditions.

Trump Signs Bill to Ease Banking Regulations

- President Donald Trump signed the largest rollback of banking regulations since the financial crisis this week. The bill passed both Congress and Senate with bipartisan support because it helps ease regulations for all but the large banks, raising the Volcker rule requirements from $50 billion to $250 billion.

- The May Fed meeting minutes were released this week and stated that an interest rate hike is most likely to occur in June. The Fed also noted that it will let inflation run above 2.0% on a temporary basis as the economy continues to recover.

- The Bloomberg Consumer Comfort Index increased to 55.2 from 54.6. The measure has been falling over the last few weeks but since the stock market is bouncing back, so is consumer confidence.

- Jobless claims saw an increase of 11,000 this week to a total of 234,000, which was higher than the consensus amount of 220,000. The four-week average increased this week, bringing the total to 219,750 but is still hovering around record-low levels.

- The Fed’s assets decreased by $0.3 billion this week, bringing the total asset base to around $4.337 trillion. The Fed has been reducing its balance sheet since September 2017, and for 2018, the Fed’s Treasury holdings will be reduced by $270 billion, while holdings of mortgage-backed securities will be reduced by $180 billion.

- During the week, money supply (M2) increased by $27.1 billion, a continuation of last week’s $16.2 billion increase.

Keep track of economic indicators that might impact the muni market.

Treasury & Municipal Yields All Decrease

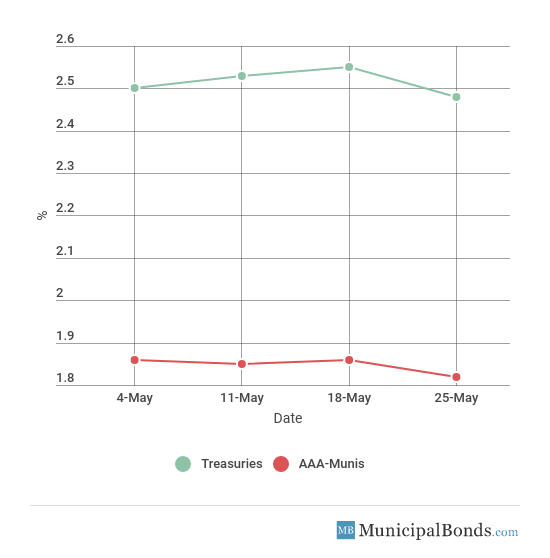

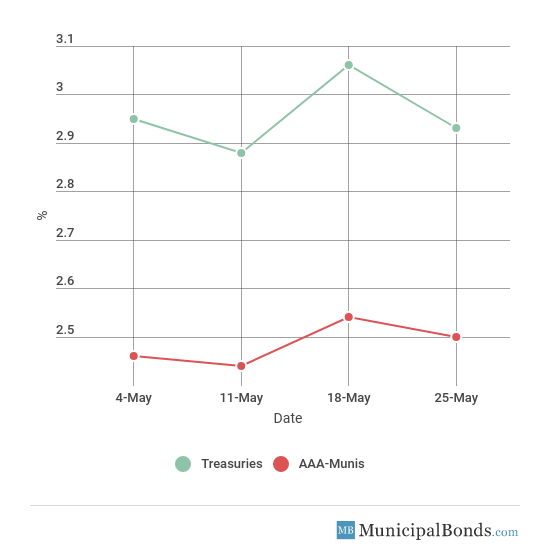

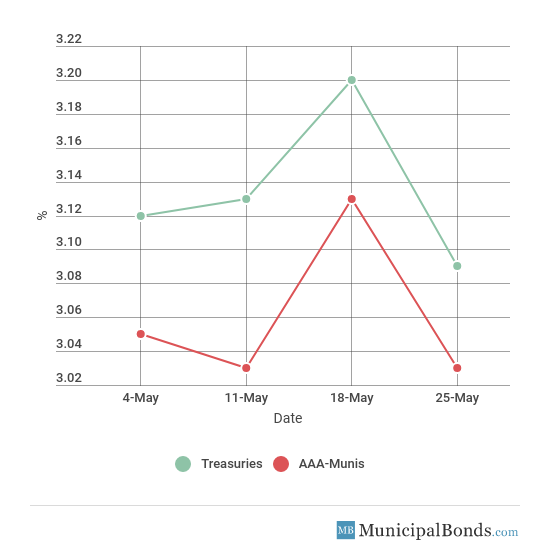

- Treasury yields all fell this week, with the 2-year Treasury falling 7 bps to yield 2.48%. The 10-year Treasury saw this week’s biggest decrease of 13 bps and now yields 2.93%. The 30-year Treasury yield decreased by 11 bps and now yields 3.09%. Municipal yields were also down this week with the 2-year AAA-rated bond falling 4 bps to yield 1.82%. The 10-year AAA-rated bond decreased by 4 bps to yield 2.50%, while the 30-year AAA-rated bond also decreased 10 bps to yield 3.03%.

- Credit spreads decreased this week, with the largest spread between the 5-year Treasury and the AAA-rated municipal bond now standing at 70 bps. Meanwhile, the spread between the 30-year securities decreased to 6 bps.

Be sure to check our newly launched Municipal Bond Screener to explore muni bond CUSIPs across the U.S. based on custom parameters including the issuing state, insurance status and a range for different bond attributes such as maturity, coupon, price and yield.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

| 2-year | 2.48% | 1.82% | 66 |

| 5-year | 2.77% | 2.07% | 70 |

| 10-year | 2.93% | 2.50% | 43 |

| 30-year | 3.09% | 3.03% | 6 |

Muni Bond Funds Sees Third Week of Inflows

- Muni bonds continued its third consecutive week of inflows with a gain of $128 million in assets under management this week.

Commonwealth of Pennsylvania Issues General Obligation Bonds

The largest issue of the week comes from the Commonwealth of Pennsylvania, which had over $1.247 billion of general obligation bonds. Almost all of the bonds issued will be used for the purpose of Capital Facilities Projects, which is designed to construct, acquire and rehabilitate projects according to the Department of General Services. The rest of the bonds are for the Growing Greener II Projects and Pennvest Projects. The bonds are rated AA- by Fitch, Aa3 by Moody’s and AA/A+ by S&P.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s upgrades Peru, IL to Aa3: Moody’s upgraded the City of Peru, Illinois’ general obligation unlimited tax (GOULT) bonds to Aa3 from A1 this week. This affects $10.6 million of outstanding debt and was warranted because the City has seen its financial status significantly improve thanks to a demographic area that is growing stronger. The City also has a manageable debt burden; even though the pension is slightly higher than expected, it is still not beyond the City’s capabilities.

Downgrade

Moody’s downgrades Wheaton, IL’s GO to Aa1: Moody’s downgraded the City of Wheaton, Illinois’ general obligation unlimited tax (GOULT) bonds to Aa1 from Aaa. This affected $19.7 million of debt due to the City’s elevated pension burden.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page here.