MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury and municipal yields all increased this week.

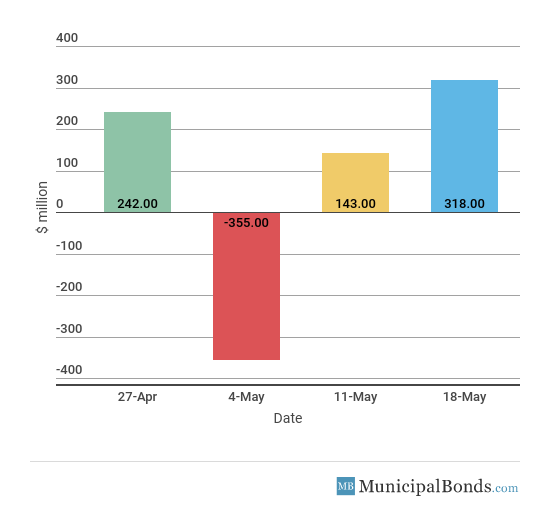

- Muni bond funds saw its second week of inflows.

- Be sure to review our previous week’s report to track the changing market conditions.

Fed Chair John Williams Uses Neutral Rate as Guidance

- San Francisco Fed Chairman, and soon to be New York Fed Chairman, John Williams launched a critical debate about the Fed’s interest rate policy. He believes the Fed has only a few more rate hikes ahead of it before rates reach a level of borrowing costs that allow the economy to remain stagnant without stimulating or slowing its progress. Williams is a firm believer in the neutral rate, which acts as a speed limit for interest rates. He also believes the neutral rate is lower than expected and it should be closely monitored.

- Dallas Fed Chairman Robert Kaplan spoke this week and announced that he believes that the economy is at or past full employment. He is well in favor of two more rate hikes this year, even though some Fed members are pushing for three.

- The Bloomberg Consumer Comfort Index decreased to 54.6 from 55.8. Although the measure has fallen over the last few weeks, it is still very high, indicating the strength of the economy.

- Jobless claims saw an increase of 11,000 this week to a total of 222,000, which was higher than the consensus amount of 215,000. This measure is still near the 49-year low, a level that was hit a few weeks ago. The four-week average again decreased this week, bringing the total to 213,250 and is still hovering around record-low levels.

- The Fed’s assets decreased by $20.6 billion this week, bringing the total asset base to around $4.338 trillion. The Fed has been reducing its balance sheet since September 2017, and for 2018, the Fed’s Treasury holdings will be reduced by $270 billion, while holdings of mortgage-backed securities will be reduced by $180 billion.

- During the week, money supply (M2) increased by $16.0 billion, a reversal of last week’s $8.2 billion decreases.

Keep track of economic indicators that might impact the muni market.

Treasury & Municipal Yields All Increase

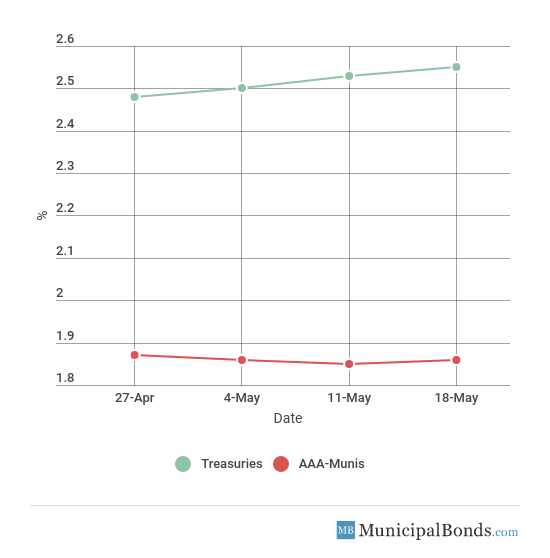

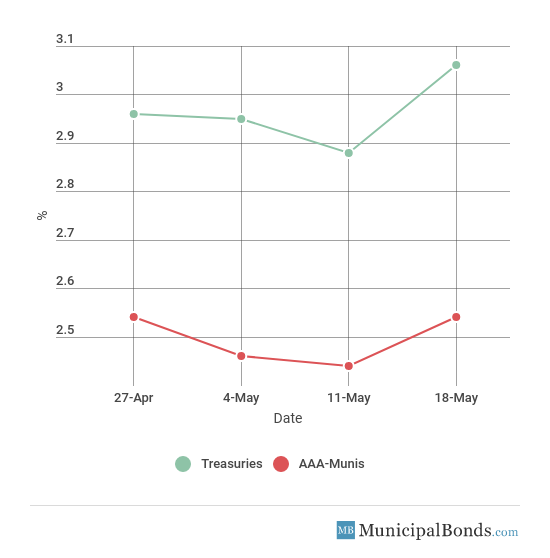

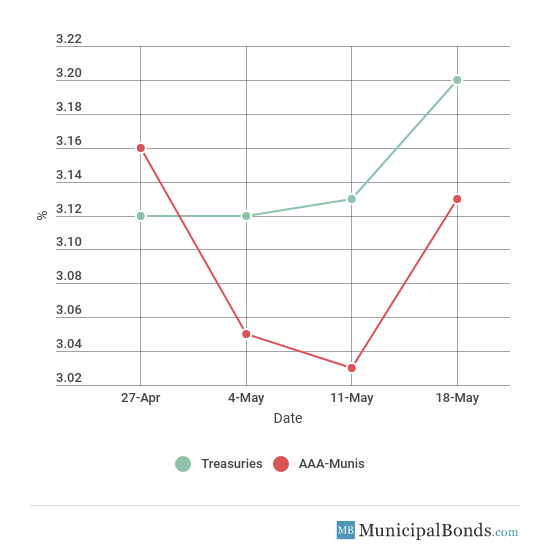

- Treasury yields all gained this week, with the 2-year Treasury gaining 2 bps to yield 2.55%. The 10-year Treasury saw this week’s biggest gain of 18 bps and now yields 3.06%. The 30-year Treasury yield increased by 7 bps and now yields 3.20%. Municipal yields were also up this week with the 2-year AAA-rated bond gaining 1 bps to yield 1.86%. The 10-year AAA-rated bond increased by 10 bps to yield 2.54%, while the 30-year AAA-rated bond also increased 10 bps to yield 3.13%.

- Credit spreads increased this week, with the largest spread between the 5-year Treasury and the AAA-rated municipal bond now standing at 76 bps. Meanwhile, the spread between the 30-year securities decreased to 7 bps.

Be sure to check our newly launched Municipal Bond Screener to explore muni bond CUSIPs across the U.S. based on custom parameters including the issuing state, insurance status and a range for different bond attributes such as maturity, coupon, price and yield.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

| 2-year | 2.55% | 1.86% | 69 |

| 5-year | 2.89% | 2.13% | 76 |

| 10-year | 3.06% | 2.54% | 52 |

| 30-year | 3.20% | 3.13% | 7 |

Muni Bond Funds See Back to Back Inflows

- Muni bonds continued its inflows this week with a gain of $318 million in assets under management this week.

The Southeast Alabama Gas Supply District Issues Revenue Bonds

The largest issue of the week comes from the State of Alabama, which had over $721 million of gas supply revenue bonds. The bonds are made up of three issues: the Series 2018A Fixed Rate with over $640 million in bonds, Series 2018B LIBOR Index Rate with over $35 million and Series 2018C SIFMA Index Rate with over $45 million. The bonds are being used to fund the ‘Gas Project,’ which consists of the acquisition of natural gas over 30 years by J. Aron & Company, LLC. The bonds are rated A by Fitch.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s upgrades Stillwater, NY’s GOULT and issuer rating to Aa3 from A1: Moody’s upgraded the Town of Stillwater, NY from A1 to Aa3 this week, which affects over $6 million of outstanding general obligation unlimited tax (GOULT) bonds. The town has seen its tax base grow considerably, thanks to higher than average wealth levels, increased financial position and a manageable debt burden.

Downgrade

Moody’s downgrades Mamaroneck UFSD, NY’s GO to Aa1: Moody’s downgraded the Mamaroneck Union Free School District of New York’s general obligation bonds to Aa1 from Aaa. The downgrade was caused because of the declining fund balance, which has seen inconsistent reserve levels.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page.