MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury yields were mixed, while municipal yields all fell.

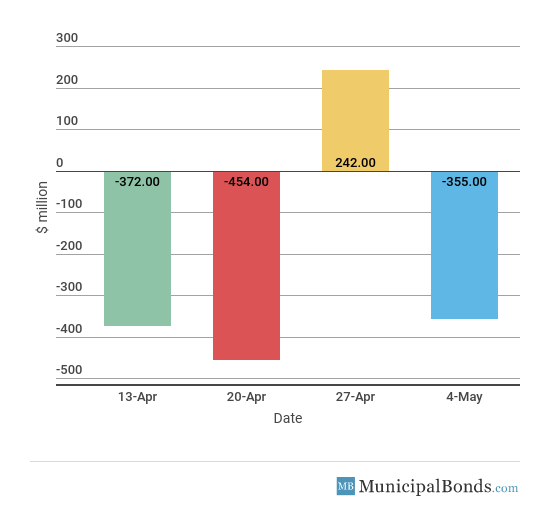

- Muni bond funds saw outflows, a reversal of last week’s inflows.

- Be sure to review our previous week’s report to track the changing market conditions.

Fed Keeps Rates Level, While Unemployment Drops to 3.9%

- The Federal Open Market Committee had its May meeting this week, and as expected, the Committee decided to keep interest rates unchanged in the 1.50% to 1.75 % range. With the recent volatility in the stock market, the Fed decided to keep rates level but still anticipates a few more hikes later this year.

- The April ADP Employment Report came in higher than expected at 204,000 versus estimates of 190,000. Although this beat expectations, it was a drop-off from March’s 228,000 level but is still a sign that the job market is very strong.

- On Friday, nonfarm payrolls were reported at 164,000, lower than the expected 190,000 on month-over-month change. Private payrolls also reported at 168,000 on a month-over-month basis, also lower than the consensus of 190,000. However, the unemployment rate came in at 3.9%, lower than the estimate of 4.0%.

- The Bloomberg Consumer Comfort Index decreased to 56.5 from 57.5. Although this measure fell again, it is still just off all-time highs.

- Jobless claims saw a slight increase of 2,000 this week to a total of 211,000, which was lower than the consensus amount of 224,000. Although this was lower than the consensus, it is still near the 49-year low at which the level hit last week. The four-week average decreased to 221,500 and is still hovering around record-low levels.

- The Fed’s assets decreased by $16.8 billion this week, bringing the total asset base to around $4.356 trillion. The Fed has been reducing its balance sheet since September 2017, and for 2018, the Fed’s Treasury holdings will be reduced by $270 billion, while holdings of mortgage-backed securities will be reduced by $180 billion.

- During the week, money supply (M2) increased by $16.1 billion, a continuation of last week’s $10.2 billion increase.

Keep track of economic indicators that might impact the muni market.

Treasuries Yields Mixed, While Municipal Yields Fall

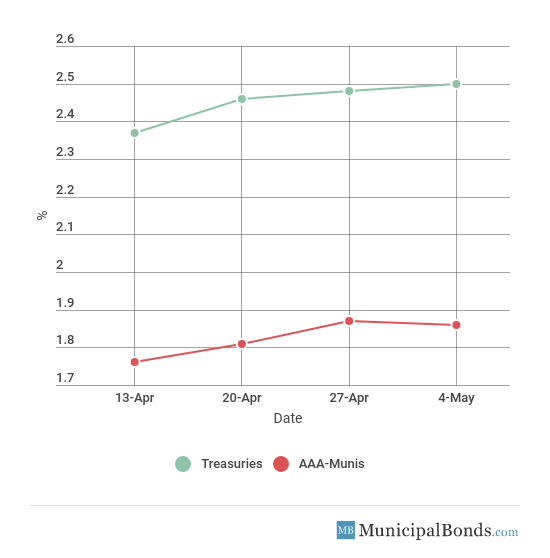

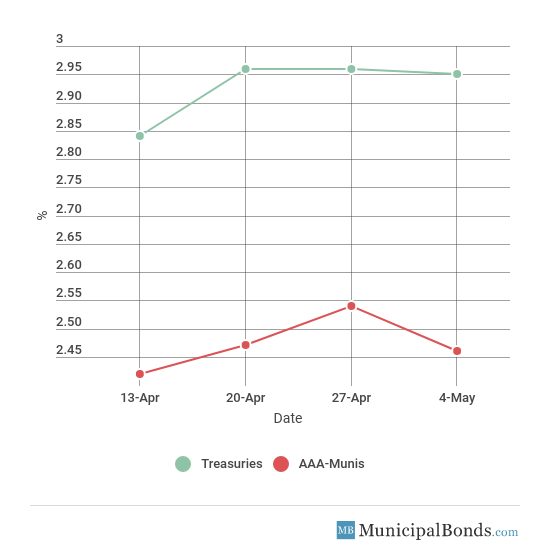

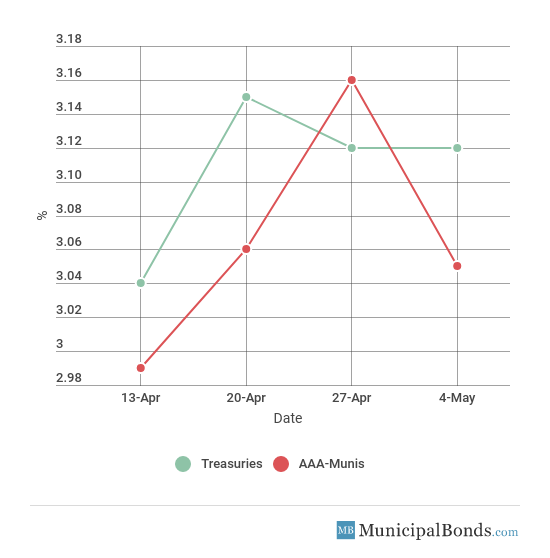

- Treasury yields were mixed this week, with the 2-year Treasury gaining 2 bps to yield 2.50%. The 10-year Treasury dropped 1 bps and now yields 2.95%. The 30-year Treasury yield saw no change and continues to yield 3.12%. Municipal yields were all down this week with the 2-year AAA-rated bond falling 1 bps to yield 1.86%. The 10-year AAA-rated bond decreased by 8 bps to yield 2.46%, while the 30-year AAA-rated bond fell 11 bps to yield 3.05%.

- Credit spreads increased this week, with the largest spread between the 2-year Treasury and the AAA-rated municipal bond now standing at 64 bps. Meanwhile, the spread between the 30-year securities increased to 7 bps.

Be sure to check our newly launched Municipal Bond Screener to explore muni bond CUSIPs across the U.S based on custom parameters including the issuing state, insurance status and a range for different bond attributes such as maturity, coupon, price and yield.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

| 2-year | 2.50% | 1.86% | 64 |

| 5-year | 2.78% | 2.15% | 63 |

| 10-year | 2.95% | 2.46% | 49 |

| 30-year | 3.12% | 3.05% | 7 |

Muni Bond Funds Reverses to Outflows

Muni bonds reversed this week and saw outflows of $355 million.

Clark County, Nevada, Issues General Obligation Stadium Improvement Bonds

The largest issue of the week comes from the State of Nevada, which had over $645 million of general obligation bonds. The bonds are being issued to finance a portion of the costs associated with the Stadium District, which will be hosting a National Football League team. The bonds are rated AA+ by S&P and Aa1 by Moody’s.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s Upgrades Brighton’s, CO’s issuer rating to Aa2 and COPs to Aa3: Moody’s upgraded the city of Brighton, Colorado, from Aa3 to Aa2 this week. This affects $28.2 million in outstanding certificates of participation bonds. The area, which is close to Denver and Denver International Airport, has seen a growing tax base, which has led to a much stronger financial position.

Downgrade

Moody’s Downgrades Michigan State University’s Long-Term Rating to Aa2; Outlook Negative: Moody’s downgraded $975 million of Michigan State University’s long-term debt and rating to Aa2 from Aa1. The school has seen serious blowback as well as a growing number of lawsuits regarding its former employee, Larry Nassar, who was sentenced to up to 175 years in prison for abuse while he was appointed as the U.S. Olympic gymnastics team doctor.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page here.