MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury yields saw increases while muni yields mostly fell.

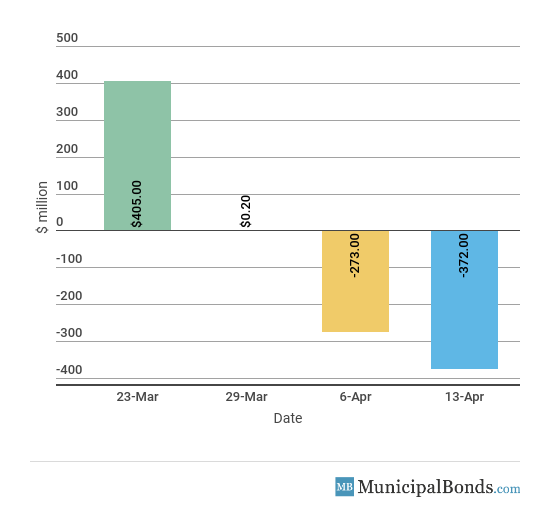

- Muni bond funds saw their second consecutive week of outflows this week.

- Be sure to review our previous week’s report to track the changing market conditions.

Fed Changes Role to Neutral

- The Federal Open Market Committee meeting minutes were released this week, which noted that members are shifting their view from accommodative to neutral in regards to the Fed’s role in the growing economy. With the Fed raising rates during this meeting, members believe the new tax plan will help bolster the economy and they want to ensure that inflation stays in check at the 2% target range.

- Import and export prices were reported this week, with import prices remaining unchanged on a month-over-month basis. This was lower than the consensus estimate of 0.2%. Export prices met expectations on a month-over-month basis at 0.3%.

- The Job Openings and Labor Turnover Survey came in lower than expected at 6.052 million versus the estimated 6.143 million. This was a 2.8% drop from the February level but still better than hirings, which fell 1.2% to reach 5.507 million.

- The Bloomberg Consumer Comfort Index increased to 58.0 from 57.2. This is the highest level in 17 years, indicating the perceived confidence tied to the tax cut and strength in the jobs market.

- Jobless claims saw a decrease of 9,000 this week to a total of 233,000, which was slightly higher than the consensus amount of 230,000. The four-week average increased to 230,000 but is still hovering around record-low levels.

- The Fed’s assets decreased by $2.4 billion this week, bringing the total asset base to around $4.384 trillion. This level is down $76 billion from the beginning of the balance sheet unwinding in October 2017.

- During the week, money supply (M2) increased by $4.5 billion, a continuation of last week’s $34.8 billion increase.

Keep track of economic indicators that might impact the muni market.

Treasury Yields Gain While Muni Yields Mostly Fall

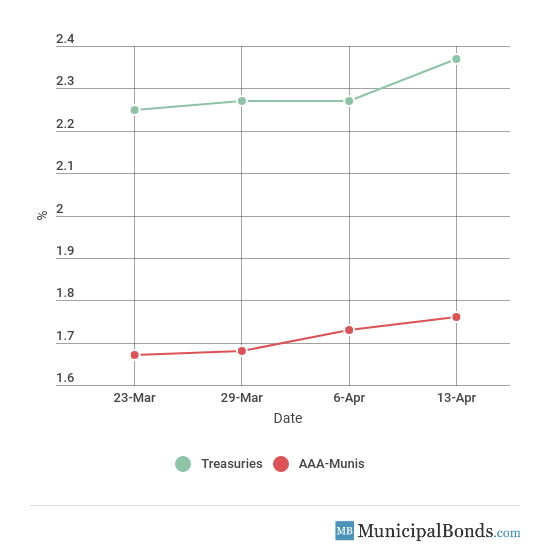

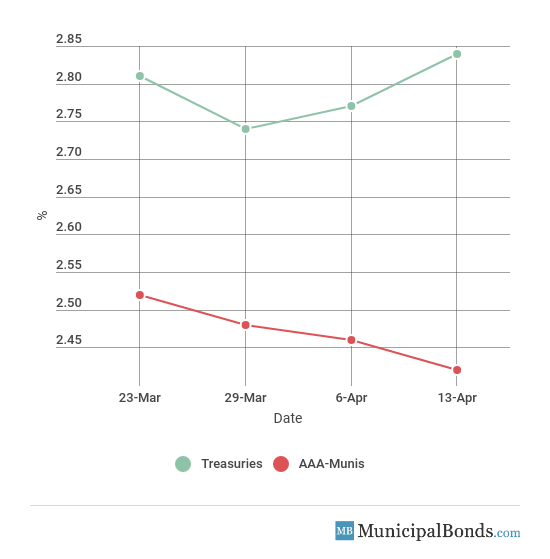

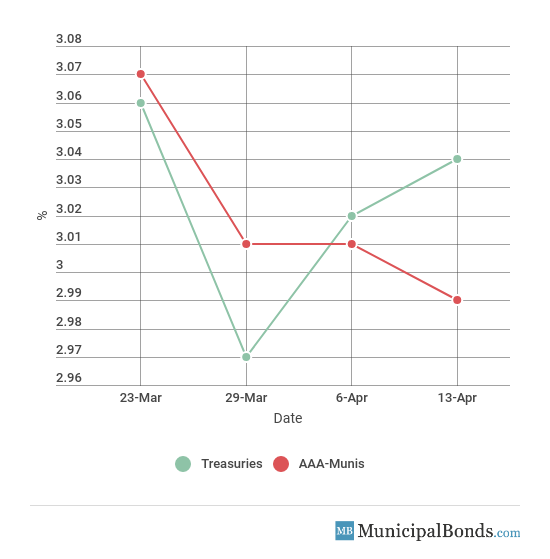

- Treasury yields were all up again this week, with the 2-year Treasury gaining 10 bps to yield 2.37%. The 10-year Treasury saw an increase of 7 bps and now yields 2.84%, while the 30-year Treasury yield increased by 2 bps and now yields 3.04%. On the contrary, municipal yields were all down this week with the exception of the 2-year AAA-rated bond, which that gained 3 bps to yield 1.76%. The 10-year AAA-rated bond decreased by 4 bps to yield 2.42%, while the 30-year AAA-rated bond dropped 2 bps to yield 2.99%.

- Credit spreads increased this week, with the largest spread between the 2-year Treasury and the AAA-rated municipal bond now standing at 61 bps. Meanwhile, the spread between the 30-year securities increased to 5 bps.

Be sure to check our Market Activity section to keep track of daily muni trades and historical trades of muni CUSIPs across the U.S.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

2-year | 2.37% | 1.76% | 61 |

5-year | 2.68% | 2.10% | 58 |

10-year | 2.84% | 2.42% | 42 |

30-year | 3.04% | 2.99% | 5 |

Muni Bond Funds Continue Outflows

Muni bonds saw their second week in a row of outflows, with assets declining by $372 million.

Tobacco Settlement Financing Corporation Issues Tobacco Settlement Bonds (NJ)

One of the largest issues of the week and the year comes from the Tobacco Settlement Financing Corporation of New Jersey, which issued over $3.15 billion in Tobacco Settlement bonds. The bond is broken down into two series: the Senior 2018A, which consists of $2.12 billion in bonds, and the Subordinate 2018B, which consists of $1.03 billion. The bonds are rated BBB by S&P.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s upgrades the Village of Mineola’s GO to Aa2: The Village of Mineola, NY, has had its outstanding general obligation unlimited tax (GOULT) upgraded to Aa2 from Aa3 this week. The area has seen a vast improvement in its financial status, thanks to a growing tax base.

Downgrade

Moody’s downgrades rating on Pasadena Unified School District’s GOs to Aa3: The Pasadena Unified School District in California had $462 million of its general obligation bonds downgraded to Aa3 from Aa2, with a negative outlook. The school district has seen a declining financial situation, which warranted a plan for budgetary relief in 2018 and 2019. The school district has seen a growing pension cost but hopes to recover shortly with a large tax base that has above-average income levels.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page.