MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury yields decline while municipal yields mostly saw gains.

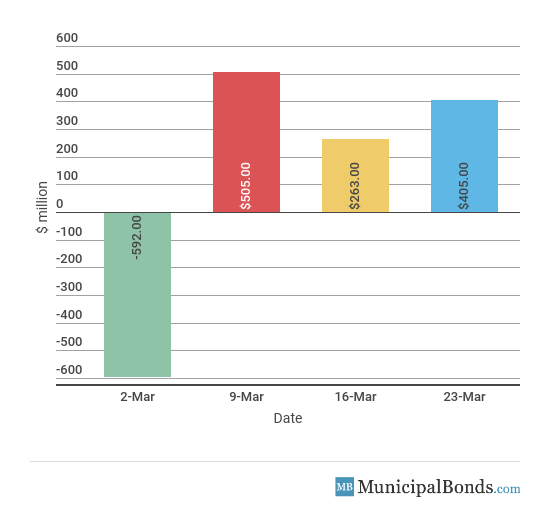

- Muni bond funds saw its third week of inflows.

- Be sure to review our previous week’s report to track the changing market conditions.

As Expected, Fed Raises Rates

- The Federal Open Market Committee met this week and, as expected, raised interest rates 0.25% to a target fed funds range of 1.50% to 1.75%. Overall, the Fed was and is expected to raise rates three times in 2018.

- Leading Indicators came in significantly higher than expected at 0.6% versus the consensus of 0.3%. Although the stock market and building permits statistics are struggling, they couldn’t hold down the index and the report says that the LEI’s trend is the best in seven years and points to strong economic growth through 2018.

- The Bloomberg Consumer Comfort Index rose 0.6 bps to 56.8, even though the stock market has been extremely volatile over the last month. The index is also only 0.2 bps below the all-time high, suggesting that consumers still believe the economy is strong.

- Jobless claims saw an increase of 3,000 this week to a total of 229,000, which is higher than the consensus amount of 225,000. The four-week average, at 223,750, is up but is still near record lows.

- The Fed’s assets decreased by $6.0 billion this week, bringing the total asset base to around $4.401 trillion. This level is down $59 billion from the beginning of balance sheet unwinding in October 2017.

- During the week, money supply (M2) increased by $9.3 billion, a continuation of last week’s $29.7 billion increase.

Keep track of economic indicators that might impact the muni market.

Treasuries Declined While Munis Mostly Saw Gains

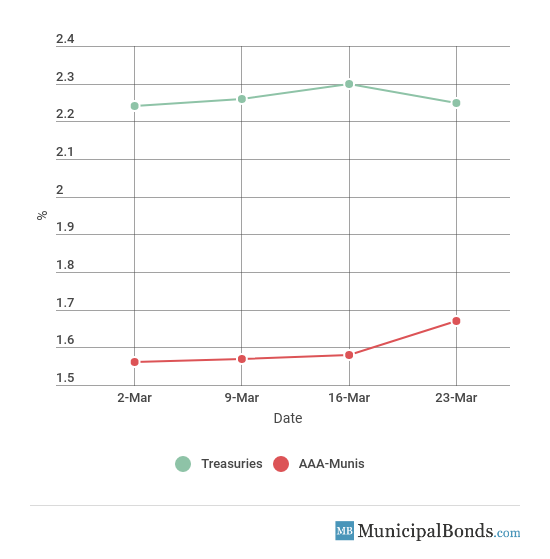

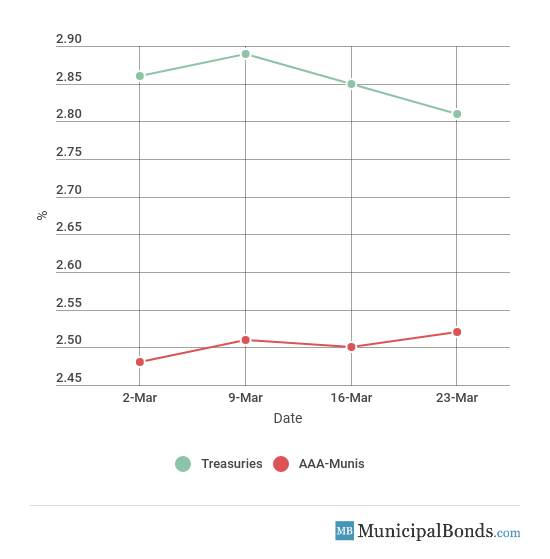

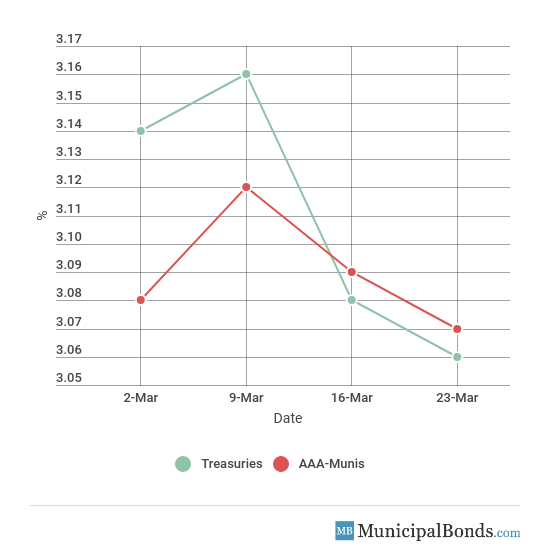

- Treasury yields were all down this week, with the 2-year Treasury decreasing by 5 bps to 2.25%. The 10-year Treasury saw a decline of 4 bps and now yields 2.81%, while the 30-year Treasury yield decreased by 2 bps and now yields 3.06%. Municipal yields mostly gained this week, with the exception of the 30-year AAA-rated bond. The 2-year AAA-rated bond saw a large increase of 9 bps to yield 1.67%. The 10-year AAA-rated bond increased by 2 bps to yield 2.52%, while the 30-year AAA-rated bond yields decreased by 2 bps to yield 3.07%.

- Credit spreads shrank this week, with the largest spread between the 2-year Treasury and the AAA-rated municipal bond now standing at 58 bps. Meanwhile, the spread between the 30-year securities remains the same at 1 bps.

Be sure to check our Market Activity section to keep track of daily muni trades and historical trades of muni CUSIPs across the U.S.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

2-year | 2.25% | 1.67% | 58 |

5-year | 2.60% | 2.07% | 53 |

10-year | 2.81% | 2.52% | 29 |

30-year | 3.06% | 3.07% | -1 |

Muni Bond Funds See Third Week of Inflows

After $263 million of inflows last week, muni bonds saw its third week of inflows with an increase of $405 million in assets under management.

New York City Transitional Finance Authority Issues Tax-Exempt Bonds (NY)

The largest issue of the week comes from the State of New York, which issued over $1.075 billion of building aid revenue bonds. The S-3 issue consists of over $500 million and Series Fiscal S-4 issue consists of over $575 million. Series Fiscal S-4 issue is made up of two subseries: Subseries S-4A which are tax exempt, while the S-4B are taxable. The bonds are rated AA by Fitch, Aa2 by Moody’s and AA by S&P.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s upgrades Steele County, MN’s GO to A2 from A3; outlook revised to stable: Moody’s upgraded the Steele County, Minnesota general obligation unlimited tax bonds to A2 from A3 this week, affecting $1.9 million of debt. At the same time, Moody’s upgraded the county’s Gross Revenue Health Care Crossover Refunding Bonds, Series 2005B from Baa2 to Baa1.

Downgrade

Moody’s downgrades Mount Healthy, OH to A2 from A1: The City of Mount Healthy in Ohio had its general obligation limited tax rating downgraded this week to A2 from A1. This affects exactly $1.4 million in outstanding debt and the downgrade was caused by the city’s increasing pension burden and declining tax base.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page here.