MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Shorter-term Treasury and municipal yields all saw gains this week while the longer-term maturities fell.

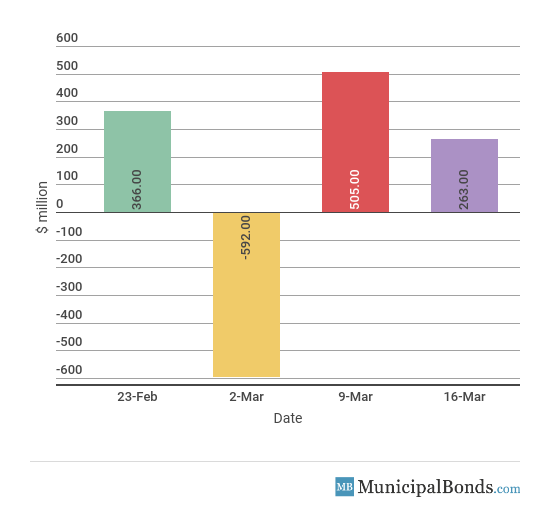

- Muni bond funds saw its second week of inflows.

- Be sure to review our previous week’s report to track the changing market conditions.

Consumer Sentiment Hits 14-Year High

- Consumer Price Index met expectations with a month-over-month change of 0.2% and 2.2% on a year-over-year change. Until wages start increasing, overall inflation might very well continue to run flat until the Federal Reserve deems it fit.

- Consumer sentiment has been showing less strength over the last year but the index for March jumped more than two points to 102.0, which is a 14-year high. A very important sign of strength is in inflation expectations for the forward year, which is up 0.2% to 2.9%. This measure will most likely be noticed in next month’s Fed meeting.

- The Job Openings and Labor Turnover Survey (JOLTS) was considerably higher than expectations, reporting at 6.312 million versus 5.800 million. This spread suggests that employers have a lot of jobs to fill and might be having a hard time finding the right candidates.

- Jobless claims saw a decrease of 4,000 this week to a total of 226,000, which is lower than the consensus amount of 229,000. The four-week average, at 221,500, is down for the seventh time in the last nine weeks and is nearly 7,000 lower than it was a month ago.

- The Fed’s assets increased by $11.2 billion this week, bringing the total asset base to around $4.407 trillion. This level is down $64 billion from the beginning of balance sheet unwinding in October 2017.

- During the week, money supply (M2) increased by $29.9 billion, a continuation of last week’s $32.3 billion increase.

Keep track of economic indicators that might impact the muni market.

Short-Term Yields Gain While Long-Term Yields Fall

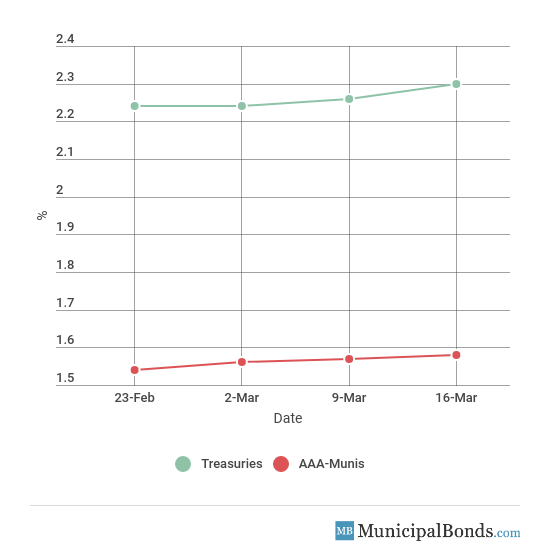

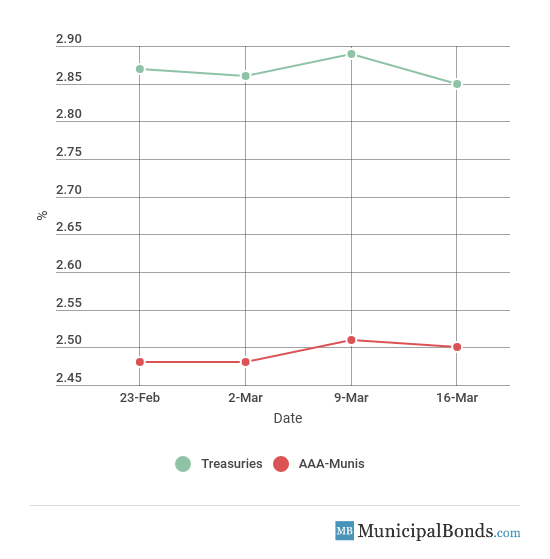

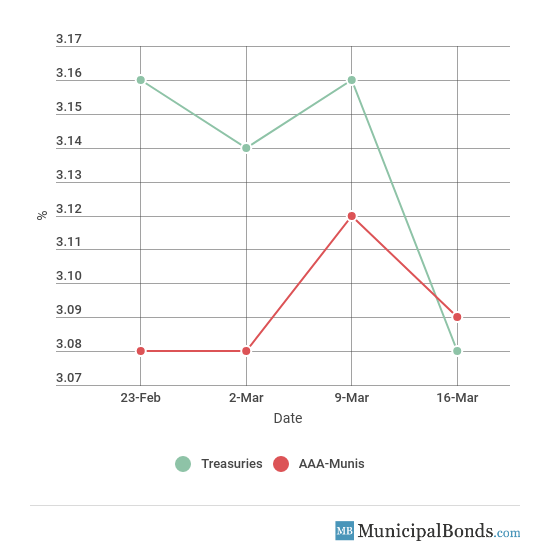

- Treasury yields were all down this week, with the exception of the 2-year Treasury that increased by 4 bps to 2.30%. The 10-year Treasury saw a decline of 4 bps and now yields 2.85%, while the 30-year Treasury yield decreased by 8 bps and now yields 3.08%. Municipal yields also declined this week, with the exception of the 2-year AAA-rated bond, which increased 1 bps to yield 1.58%. The 10-year AAA-rated bond decreased by 1 bps to yield 2.50%, while the 30-year AAA-rated bond yields decreased by 3 bps to yield 3.09%.

- Credit spreads grew this week, with the largest spread between the 2-year Treasury and the AAA-rated municipal bond now standing at 72 bps. Meanwhile, the spread between the 30-year securities decreased to 1 bps from the previous week’s figure of 4 bps.

Be sure to check our Market Activity section to keep track of daily muni trades and historical trades of muni CUSIPs across the U.S.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

2-year | 2.30% | 1.58% | 72 |

5-year | 2.65% | 2.01% | 64 |

10-year | 2.85% | 2.50% | 35 |

30-year | 3.08% | 3.09% | -1 |

Muni Bond Funds See Second Week of Inflows

After $505 million of inflows last week, muni bonds saw its second week of inflows with an increase of $263 million in assets under management.

State of California Issues Various Purpose General Obligation Bonds (CA)

The largest issue of the week comes from the State of California, which issued over $2.18 billion of general obligation bonds. One issue consists of over $1.51 billion, which were various purpose general obligation bonds and will mostly be used for construction purposes. The other issue consists of over $663 billion various purpose general obligation refunding bonds. The bonds are rated AA- by Fitch, Aa3 by Moody’s and AA- by S&P.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s Upgrades Wood-Ridge, NJ’s GO to A1 from A2: Wood-Ridge of New Jersey had $852,000 of its outstanding general obligation unlimited tax debt, which totals $47.2 million, upgraded to A1 from A2. The area has recently financially benefited from new development and a wealthy tax base that has seen rising income levels.

Downgrade

Moody’s Downgrades Aldine ISD, TX GOULT to Aa2; Lease Rev to Aa3; Outlook Stable: The Independent School District of Aldine, Texas had its outstanding general obligation bonds downgraded to Aa2 and its outstanding lease revenue bonds downgraded to Aa3. The Houston metropolitan-based area has seen its financial reserves weaken because its large tax base has seen its wealth levels stand below the median average.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page here.